M&A Consulting Services Tailored for Colombia

Colombia’s fast-changing market creates both opportunities and challenges for investors. Shifting regulations, regional disparities, and high competition can complicate even the most promising deal. At Midas, we specialize in M&A Consulting in Colombia—helping you navigate complexity, mitigate risks, and secure long-term value

What does M&A consulting with Midas look like in Colombia?

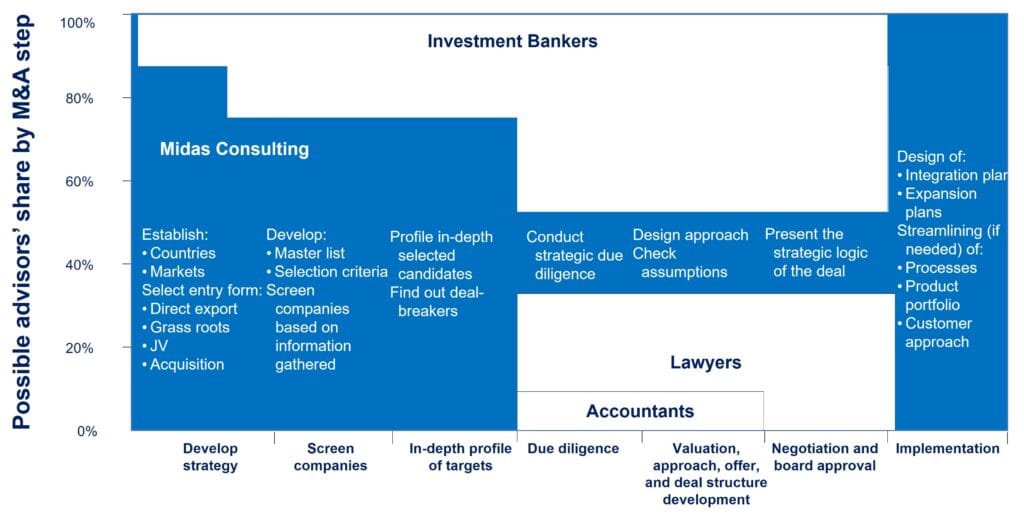

We support the full M&A cycle:

- Understanding – Clarify acquisition or divestment goals

- Screening – Spot the right targets in Colombia’s fragmented markets

- Analyzing – Reveal risks and opportunities with competitor mapping and market insight

- Approaching – Initiate conversations with potential targets strategically

- Negotiating – Gain advantage by understanding counterpart priorities

- Implementation – Ensure post-merger integration across regions and cultures

Check out the complete guide with all the steps to build your M&A search strategy—click here

What makes this M&A consulting approach so effective in Colombia?

Three realities make M&A uniquely complex here:

- Regulatory and fiscal unpredictability: Sudden tax reforms and sector-specific rules impact valuations

- Regional fragmentation: Consumer habits and competitive landscapes differ sharply between Bogotá, Medellín, and the Caribbean coast

- High competitive intensity: Local players and global entrants alike move fast in key sectors like FMCG, retail, and energy

How can our M&A consulting help you succeed in Colombia

- Clarity in a fragmented, fast-moving market

- Stronger negotiation positions based on real insight

- Tailored post-merger integration strategies

- Faster path to profitable growth

With 25+ years of experience and an NPS of 82.2%, we help you approach mergers and acquisitions in Colombia with confidence

Ready to move forward in Colombia?

Some of our customers in Colombia:

Case example, strengthening presence in Colombia’s food sector

Background and challenges

A multinational food company wanted to acquire a Colombian player but was unsure about integration risks and consumer alignment

Approach

We conducted due diligence, mapped regional demand, and stress-tested synergies in distribution and sales. A workshop with both teams helped anticipate cultural and organizational friction

Results

Clear view of risks and opportunities by region

Adjusted financial model to reflect real consumer behavior

Smooth post-merger integration, boosting market share within one year