M&A Consulting Services Tailored for Brazil

Brazil is one of Latin America’s most attractive but also most complex markets. From dynamic consumer demand to shifting regulations and regional differences, every deal requires a balance of speed and caution. At Midas Consulting, we provide M&A Consulting in Brazil that helps you navigate complexity, minimize risks, and maximize value creation

What does M&A consulting with Midas look like in Brazil?

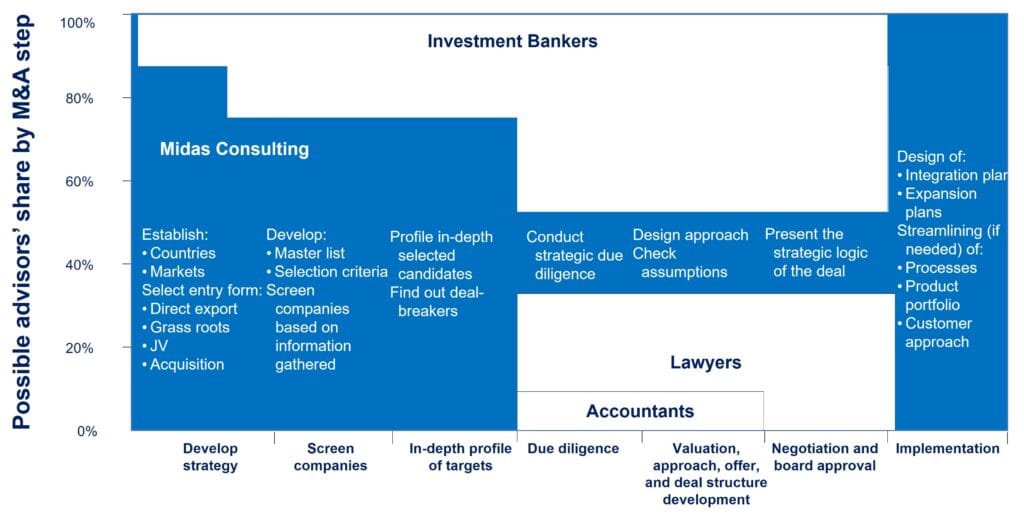

We accompany you throughout the M&A cycle:

- Understanding – Define your acquisition or divestment objectives clearly

- Screening – Identify and filter targets aligned with your strategy

- Analyzing – Assess opportunities and uncover risks using market intelligence and competitor analysis

- Approaching – Discreetly open conversations with potential targets

- Negotiating – Support your negotiations by uncovering counterpart needs and structuring better deals

- Implementation – Ensure integration creates value across Brazil’s diverse regions

Access our detailed guide to create a solid M&A search strategy, step by step. Click here

Why does this M&A consulting approach work particularly well in Brazil?

Because three challenges shape M&A in Brazil:

- Regulatory and tax complexity: Intricate labor laws, local taxes (ICMS, ISS, PIS/COFINS), and regulatory approvals can slow or reshape deals

- Regional diversity: What works in São Paulo may not succeed in the Northeast or South; integration strategies must adapt

- Competitive intensity: Local champions, global entrants, and a fast-growing startup ecosystem mean competition is fierce and fast-moving

Our approach ensures you see these issues early and plan accordingly

What you get from our M&A consulting in Brazil

- Visibility into regulatory, tax, and market risks

- Tailored insights into regional opportunities and challenges

- Stronger negotiation position with local intelligence

- Integration strategies adapted to Brazil’s complexity

With over 25 years of experience and a client-rated NPS of 82.2%, we help you make smarter, safer, and more profitable M&A decisions in Brazil

Ready to pursue opportunities with clarity and confidence?

Contact us to successfully acquire your ideal target company!

Some of our customers in Brazil:

Case example, entering Brazil’s healthcare sector

Background and challenges

An international healthcare group wanted to acquire a mid-sized Brazilian diagnostics company but lacked clarity on local dynamics and competitive risks

Approach

We conducted market due diligence, mapping competitors, patient flows, regulatory hurdles, and local reimbursement models. We also facilitated scenario planning to stress-test the investment under different policy and demand conditions

Results

The client adjusted its valuation, saving 20% on acquisition price

A new go-to-market strategy prioritized private insurance partnerships and tiered service models

Within the first year, the company expanded its footprint in São Paulo and Rio, achieving faster-than-expected revenue growth