M&A Consulting Services Tailored for Chile

Chile is one of Latin America’s most stable and open economies—but that doesn’t mean deals are simple. Social pressures, regulatory shifts, and strong local competition create a challenging landscape for investors. At Midas, we specialize in M&A Consulting in Chile to help you anticipate risks, capture opportunities, and ensure that every deal creates long-term value

What does M&A consulting with Midas include in Chile?

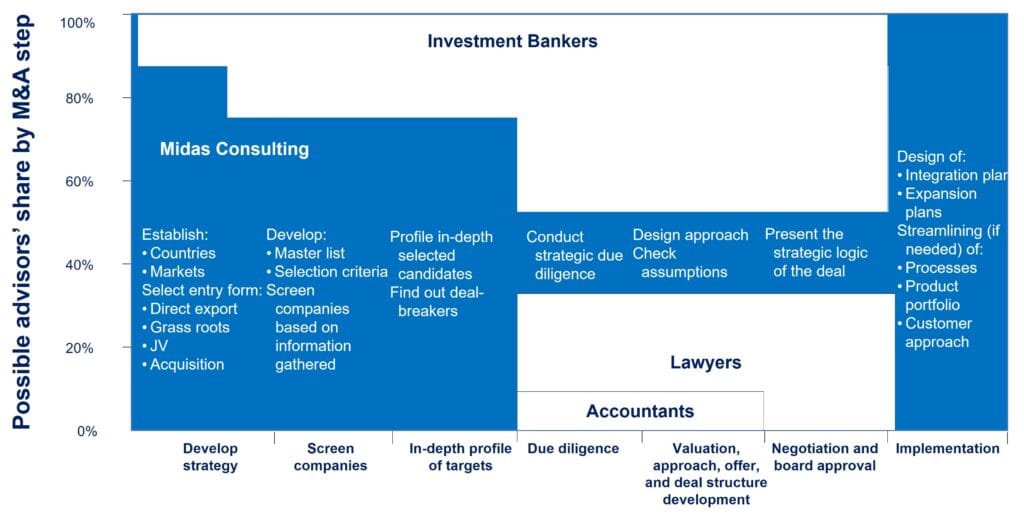

We accompany you through the entire M&A journey:

- Understanding – Define your acquisition or divestment goals with precision

- Screening – Identify and filter the right targets that align with your strategy

- Analyzing – Assess opportunities and reveal hidden risks through market intelligence and competitor mapping

- Approaching – Open conversations with potential targets discreetly and strategically

- Negotiating – Support your negotiations by uncovering counterpart needs and strengthening your deal position

- Implementation – Guide post-merger integration to ensure synergies materialize and cultural alignment is achieved

Click here to see the guide that shows you how to build your M&A search strategy from start to finish

Why does this M&A consulting approach work particularly well in Chile?

Because three factors make M&A in Chile uniquely demanding:

- Regulatory and political shifts: From constitutional reforms to changing sector-specific rules, the regulatory environment can reshape deals

- Social expectations: Issues of sustainability, labor rights, and corporate reputation weigh heavily on M&A transactions

- Intense competition: Local incumbents, regional players, and international entrants create a crowded and fast-moving marketplace

Our consulting process helps you cut through these complexities—building strategies that are realistic, aligned, and future-proof

What you gain from our M&A consulting in Chile

- Deep understanding of Chile’s regulatory and political context

- Insight into local consumer behavior and competitive intensity

- A stronger position at the negotiation table

- Integration strategies that respect local realities and accelerate value creation

With over 25 years of experience and an NPS of 82.2, we help companies pursue mergers and acquisitions in Chile with clarity, focus, and confidence

Ready to move forward with confidence in Chile?

Contact us to successfully acquire the company you need!

Some of our customers in Chile:

Case example, expanding in Chile’s retail sector

Background and challenges

A multinational retailer was exploring the acquisition of a Chilean chain but faced uncertainty around consumer behavior shifts, regulatory hurdles, and integration risks

Approach

We led a market due diligence process, analyzing competitor strategies, evolving consumer habits, and regional variations. We also facilitated scenario planning workshops to stress-test the investment against different political and social contexts

Results

Identified hidden risks in the target’s supplier agreements, reducing exposure

Adjusted valuation assumptions to reflect future margin pressures

Built a post-merger integration plan that aligned organizational culture and ensured fast operational synergies