M&A Consulting Tailored for Argentina

Acquiring or divesting in Argentina requires more than financial expertise. The country offers real growth opportunities, but also unique challenges: volatile macro conditions, shifting regulations, and a high degree of informality in many sectors. Midas’ M&A consulting, we help you navigate these complexities so your deals don’t just close—they deliver lasting value

What does M&A consulting with Midas look like in Argentina?

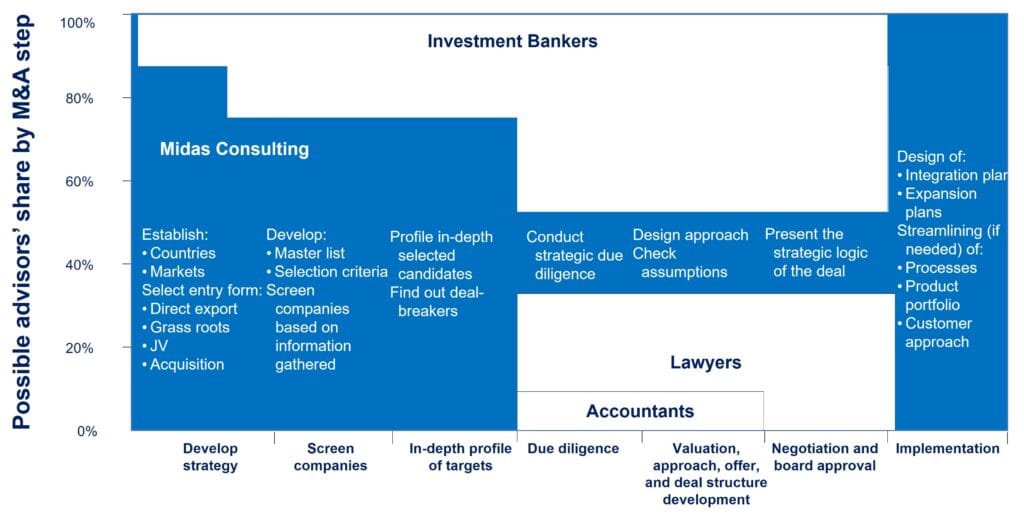

We guide you through the full M&A process:

- Understanding – Understand your objectives and what makes a target attractive

- Screening – Identify and filter potential targets aligned with your goals

- Analyzing – Assess opportunities and uncover hidden risks through market intelligence

- Approaching – Discreetly connect with companies and initiate conversations

- Negotiating – Support in understanding the counterpart’s priorities and structuring deals

- Implementation – Ensure integration and expansion plans create the expected value

Discover how to develop your M&A search strategy with a structured approach—click here

Why does this M&A consulting approach work particularly well in Argentina?

Because three challenges shape every deal:

- Macroeconomic volatility: Exchange rate swings, inflation, and credit constraints affect valuations and timing

- Regulatory uncertainty: Import restrictions, capital controls, and sudden policy changes can alter deal feasibility

- Informality in the market: Many businesses underreport or lack transparent data—making local intelligence essential

Our structured approach helps you cut through this complexity and negotiate from a position of strength

What you gain from our M&A consulting in Argentina

- Clear visibility of hidden risks and market realities

- Confidence in valuations adjusted for local dynamics

- Stronger negotiation based on counterpart insights

- Integration strategies tailored to Argentina’s unique business environment

With more than 25 years of experience and an NPS of 82.2%, we help companies succeed in one of Latin America’s most complex but opportunity-rich markets

Ready to explore M&A opportunities in Argentina with confidence?

Contact us to successfully acquire a company!

Some of our customers in Argentina:

Case example, repositioning in a volatile market

Background and challenges

A multinational food company was considering acquiring a local player in Argentina’s dairy sector. While the financials looked promising, there were doubts about sustainability under volatile macro conditions

Approach

We conducted a rapid due diligence combining financial analysis with 20+ interviews across the supply chain, competitors, and distributors. We identified hidden cost pressures, regulatory risks, and consumer trends shaping the category

Results

The client avoided overpaying the target by 25% through negotiation

A new integration roadmap prioritized pricing flexibility and local sourcing

Within a year, the acquisition stabilized and delivered profitability above forecast, even amid inflation and currency swings